Insights into Mobile App Subscriptions – RevenueCat Report 2024

How does the landscape of mobile apps in the SaaS model look like in 2024 according to data from RevenueCat? How many mobile apps utilize a trial? What does the conversion to payment in mobile apps look like where the main monetization model is a subscription? Is it worth using Apple Search Ads Advanced to promote a SaaS mobile app? All about this in the post below.

RevenueCat is a subscription and in-app purchase management platform that helps developers and companies build, analyze, and grow their businesses related to in-app purchases and subscriptions. It offers a set of tools and APIs that simplify the integration of in-app purchases on iOS, Android, and web apps.

Thanks to this platform, you can track indicators such as conversion rates, retention, and average revenue per user (ARPU). RevenueCat provides tools for price optimization, automation of recovering lost revenue, and combating fraud. It is a tool for mobile app developers where the main monetization model is subscription.

RevenueCat is the perfect solution for anyone who wants to: facilitate the management of subscriptions in a mobile app, obtain accurate and reliable subscription data, increase subscription revenue, and reduce the cost of maintaining a user in a subscription in a mobile app. Developers can integrate RevenueCat with their apps using its SDKs available for iOS, Android, Flutter, React Native, and Unity, or directly access its API for custom integrations.

This tool released a great report “State of Subscription Apps 2024” this week. The report prepared by RevenueCat provides an in-depth analysis of the subscription landscape in mobile apps, based on the largest data set in the world. It covers a range of topics, from payment conversion rates through user retention strategies to monetization techniques, and offers insight into how SaaS (subscription model) mobile apps can increase their subscription revenue.

It points to a trend of renormalization and acceleration of growth after the pandemic and other global challenges, such as privacy changes and antitrust issues. The impact of AI and LLM on consumer apps is noticeable, with predictions that AI will be a key driver in the second phase of the mobile era.

Methodology

- The data comes from over 30,000 applications using the RevenueCat SDK and integrations.

- The benchmarks in the report are based on anonymous data, with new divisions by category, platform, and region.

Summarizing the “State of Subscription Apps 2024” report from RevenueCat, we can highlight several key findings regarding the subscription app market:

Conversion and retention in SaaS mobile apps

Source: RevenueCat

- On average, only 1.7% of downloads convert to paid subscribers within the first 30 days.

- he percentage of monthly subscribers who remain after 12 months has fallen by 14% over the last year across various categories.

- More than 10% of users who cancel a monthly subscription reactivate it within 12 months, with higher reactivation rates in categories such as Media & Entertainment.

- Weekly subscriptions lose two-thirds of subscribers by the fourth month. They exhibit relatively weak subscriber retention rates. Even the best performers in this category have comparably weak results relative to other subscription lengths, with the top quartile of renewals achieving just over 40% after three renewals compared to about 52% for monthly subscriptions.

- Weekly subscriptions generally are not the best choice for products expecting long-term retention but can be beneficial for a quick return on advertising spend or for apps with limited use cases of repetition.

- The best market and category combination, i.e., education in South Korea, achieves an exceptional conversion rate of 10.7% from downloaded apps to new paid subscribers, which is a significant multiple compared to the average conversion of 1.7% across all categories and regions. This shows how specific market segments can outperform general trends.

Monetization

- The average realized LTV (Lifetime Value) per download in North America after 14 days is four times higher than the global average ($0.35 compared to $0.08).

- The top 5% of highest-earning newly launched apps generate over 200 times more monthly revenue than the bottom quartile one year after launch.

- Even minor changes, such as price localization across different markets, modifications to content on paywalls, discounts, and improvements in the onboarding process, can significantly impact conversion and LTV, which is crucial for the LTV to CAC (Customer Acquisition Cost) ratio.

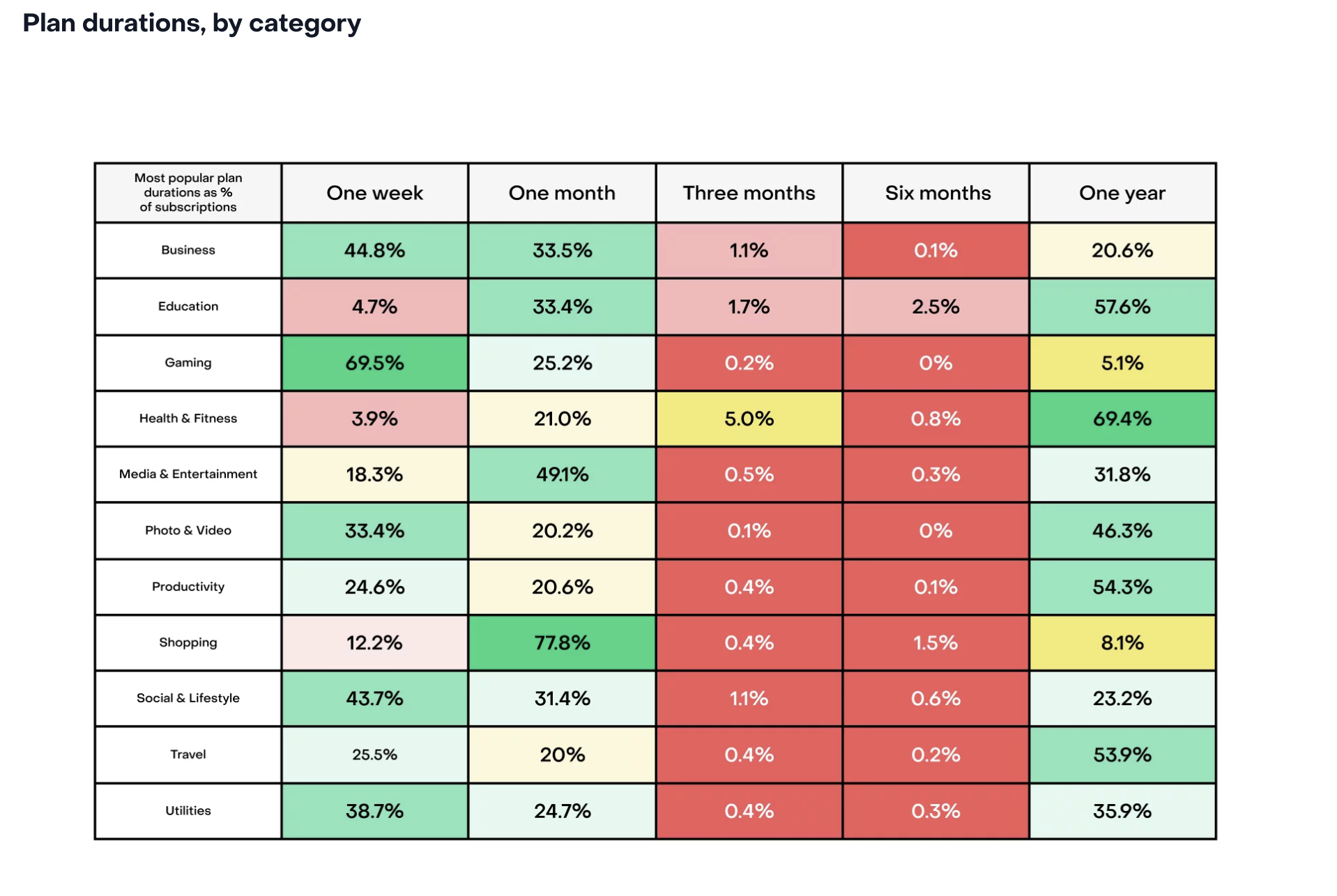

Prices and Packages

- The most common price points for subscription apps (SaaS) have remained stable year over year, with the most popular plans being weekly at $4.99, monthly at $9.99, and yearly at $29.99.

- App categories show standard pricing preferences, but with exceptions such as education, where the preferred annual price point is $59.99.

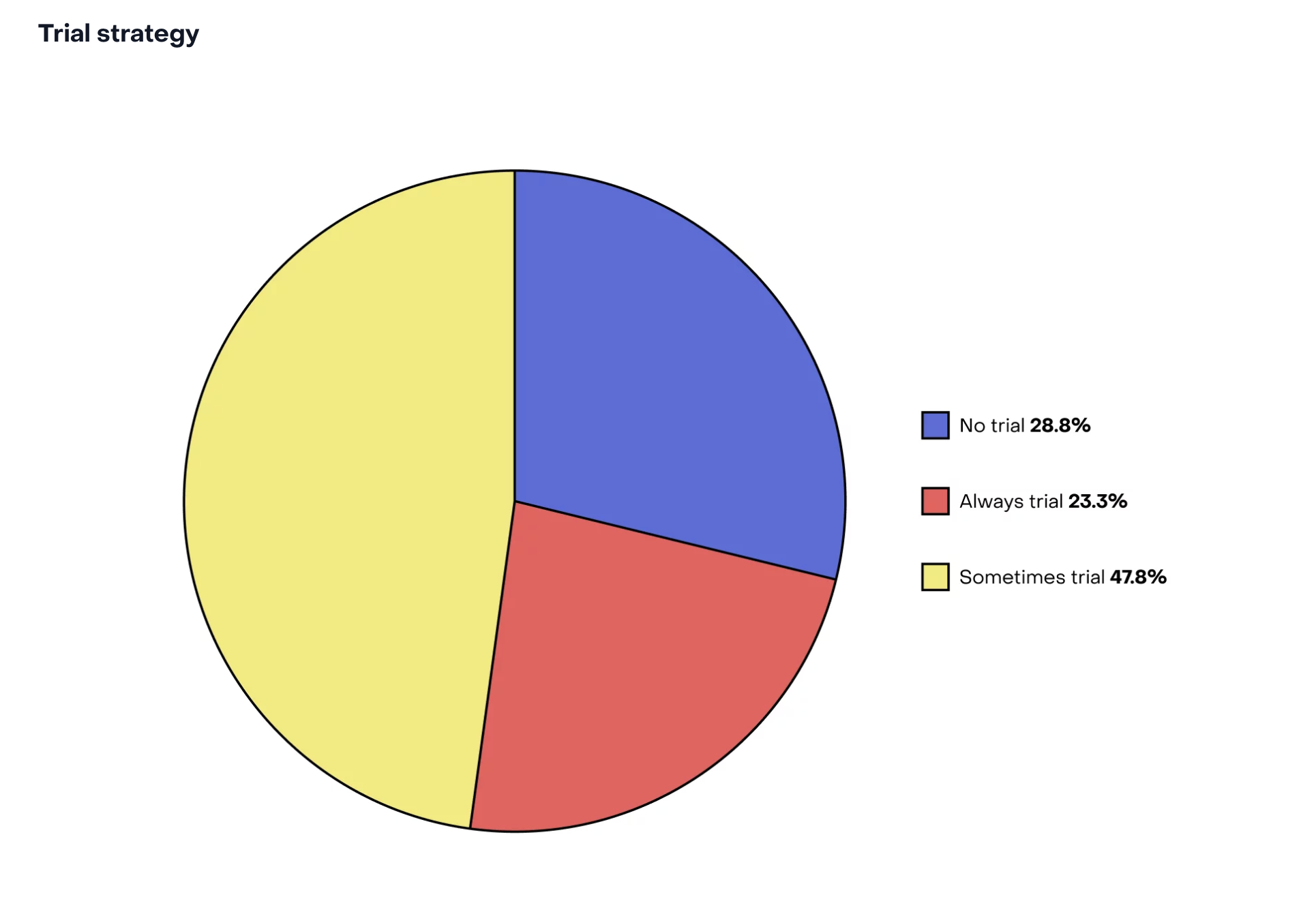

Free Trials

Source: RevenueCat

- Shorter trial periods (5-9 days) are becoming the norm, although the absolute number of longer trial periods (17-32 days) has increased by about 50%.

- Apps in the Media & Entertainment and Shopping categories offer longer trial periods, possibly as a way to increase revenue from purchases.

Monetization Strategies

- Most apps in categories such as Business, Education, Health & Fitness, and Tools use a subscription-only model.

- Games stand out by mixing subscription and consumable models.

Promoting SaaS Mobile Apps via Apple Search Ads

- In the “State of Subscription Apps 2024” report, the topic of using Apple Search Ads (ASA) as one of the key tools in the user acquisition strategy for subscription apps was addressed. Apple Search Ads offers app developers the opportunity to display ads in the App Store search results, allowing for direct reach to potential users at the moment they are searching for new apps.

- Apple Search Ads Advanced (ASA) are particularly valuable due to the high purchase intent of users using the App Store search engine – they are actively engaged in searching for apps, which increases the likelihood of installation. Moreover, ASA provides very precise targeting, allowing developers to direct their ads to the most relevant user segments, based on criteria such as age, gender, location, or previous purchasing behaviors.

- In Apple Search Ads Advanced, you can also target users who use your other mobile apps.

Using Apple Search Ads Advanced has several significant advantages:

- High Relevance and Purchase Intent: Users searching in the App Store are in the deep phase of the conversion funnel, meaning they are more inclined to install apps. oznacza, że są bardziej skłonni do instalacji aplikacji.

- Accurate Attribution: ASA offers precise tracking that allows developers to accurately attribute revenue to advertising expenses, which is crucial for optimizing ROI. Cohorts from Apple Search Ads Advanced can be analyzed in MMP tools like Appsflyer.

- Budget Flexibility: Campaigns can be scaled up or down with great flexibility, allowing for efficient management of spending based on the available budget and marketing objectives.

- Conversion Optimization: ASA ads allow for testing different creative variations and keywords, which can significantly increase campaign efficiency through conversion optimization. Ads can be displayed in search results, in the Today Tab, in the Search Tab, or when browsing selected apps.

- However, the report also emphasizes that the effectiveness of ASA is not unlimited. Increasing the scale of advertising spend on this channel (or any other) inevitably leads to a decrease in overall efficiency, meaning developers must carefully monitor the return on investment (ROI) and make appropriate adjustments to the strategy.

In summary, Apple Search Ads Advanced constitutes a powerful tool in the marketing arsenal of subscription apps, enabling targeting users with high purchase intent. The Apple Ads Attribution API provides much more detailed data than the post-launch SkAdNetwork. In my opinion, one of Apple’s goals in introducing SKAN was to redirect iOS app marketing budgets from Facebook and Google Ads to Apple Search Ads Advanced. Is Apple Search Ads Advanced a game-changer in promoting iOS mobile apps operating in a SaaS model? It is not. A potential game-changer could be an ad network created by Apple itself.

According to the report, to fully leverage this channel’s potential, developers need to engage in continuous optimization and monitoring of their campaign effectiveness. Besides using ASA ads, apps should explore various marketing channels, such as Meta and other mobile user acquisition channels.

The rising interest in AI and LLM (Large Language Models) technology might impact future monetization and user engagement strategies in apps.

What else can we find in the report?

Developers should experiment with different trial lengths to find the optimal solution that best converts users into paying subscribers. Applying various trial strategies depending on the customer segment may help better tailor the offer to their needs and expectations. Tracking the outcomes of different trial strategies and their impact on conversion and retention is crucial for optimizing monetization and the overall app strategy.

In conclusion, the “State of Subscription Apps 2024” report provides valuable insights into current trends and future development directions in the subscription app sector, highlighting the importance of innovation, adaptation, and continuous experimentation to succeed in this competitive space. The report points to dynamic changes in the subscription app landscape, emphasizing the significance of pricing strategies, packages, and monetization in maintaining and growing the subscriber base.

The full report can be found at this address. It is indeed a substantial piece of work. If you are involved in marketing mobile apps operating on a subscription model, you should familiarize yourself with this report.

Mobile App and Game Uninstallation Report – Appsflyer Data (2024 Edition)

How does the landscape of mobile apps in the SaaS model look like in 2024 according...